how much state tax do you pay on a 457 withdrawal

State Tax Withholding for Qualified Plans MPPPSP403b401k457b Effective 3302020 Below are the state tax withholding requirements which will be withheld from any distribution. Please note that state taxes are entered in a separate entry field.

Is The Tsp A 457 Plan Government Worker Fi

If you are unsure the calculator will choose 25.

. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans. 6 13 20 Withdrawing 1000 leaves you with 710 after taxes Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. But state tax laws may differ on whether IRA distributions can be counted as retirement income.

Are distributions from a state deferred section 457 compensation plan taxable by New York State. 16 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be. Beneficiary distributions avoid the early withdrawal penalty of 10 percent.

It depends what state. Federal income tax rate Your estimated federal tax rate. Rolling over the portion.

Please note that state taxes are entered in a separate entry field. Federal income tax rate Your estimated federal tax rate. For example if you withdraw 10000 you must pay your taxes and.

If you are unsure the calculator will choose 25. Rather than withdrawing funds participants may roll over their 457. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

Multiply the taxable portion of your distribution by your federal marginal tax rate to calculate your federal income taxes on your early IRA withdrawal. For example if you fall. However distributions received after the pensioner turned 59 12 would.

These distributions are taxed as regular income but the 10 early withdrawal penalty is never applied. Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the. For example if you fall in the 12 tax.

In most circumstances an early withdrawal triggers a penalty equal to 10 percent of the withdrawal amount. However if you withdraw from. However you will have to pay income taxes on the.

A resident of Kentucky for example can include IRA withdrawals within the. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Basically any amount you withdraw from your 401 k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return.

There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will ultimately owe 20 of your income or not.

457 Contribution Limits For 2022

A Guide To 457 B Retirement Plans Smartasset

457 Plan Types Of 457 Plan Advantages And Disadvantages

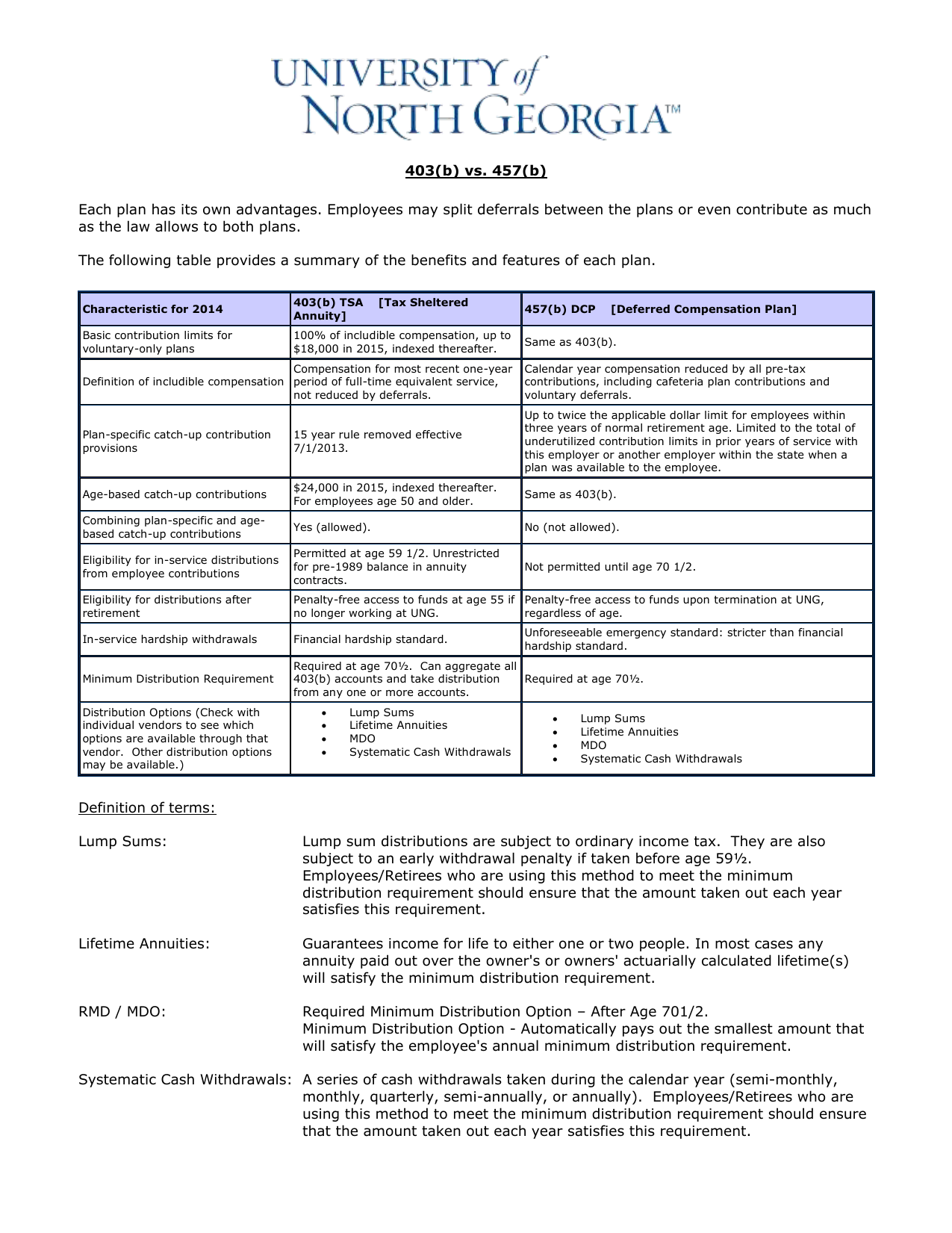

How 403 B And 457 Plans Work Together David Waldrop Cfp

What Makes A 457 B Plan Different

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

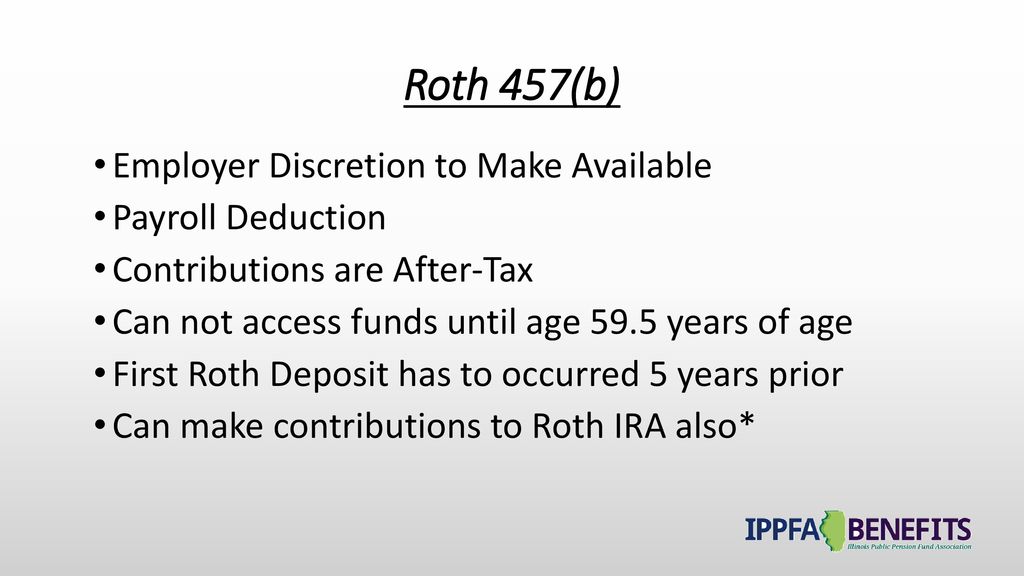

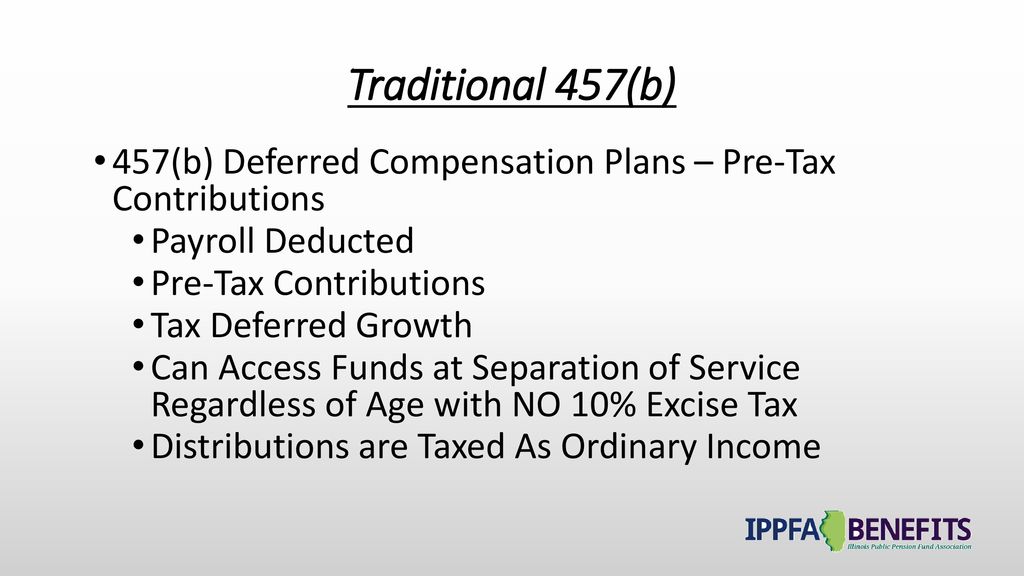

457 B Deferred Compensation Plan Basics Ppt Download

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Traditional Ira

457 B Deferred Compensation Plan Basics Ppt Download

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax

403 B And 457 B What S The Difference The Motley Fool

Should Physicians Use 457 B As A Tax Saving Vehicle

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax

A Checklist For Drafting Section 457 F Plans For Tax Exempt Employers